As you plan for the future, you might be asking yourself, “How can I minimize my tax burden in retirement?” or “What strategies can help me keep more of my hard-earned money?” Tax-related concerns can have a significant impact on your retirement plans, potentially limiting your financial freedom.

We focus on tax minimization planning and will help you find the best vehicle to help reduce your taxes and give you the best chance for tax-free income in retirement. We work with tax attorneys, estate planning attorneys, and CPAs to ensure the most accurate tax strategies can be implemented to take advantage of existing tax codes and regulations that change regularly.

On non-qualified accounts, we employ tax-saving strategies to reduce unnecessary taxable income to avoid jumping brackets due to capital gains and dividends. We have access to strategies where we can move between funds and fund families without creating capital gains or dividends. Normally, selling or moving from one family to another creates a taxable event and could cause tax related problems as a result. Tax-loss harvesting evaluates a portfolio’s total invested positions and sees if any short-term losses can be taken on an annual basis to limit tax exposure. We will coordinate with your current CPAs and attorneys to verify strategies that will work properly in your financial situation. If you do not have a CPA or an attorney, we will recommend one to you and connect you with them. Current tax returns show substantial tax risk due to capital gains and dividends if no losses are available to offset those gains.

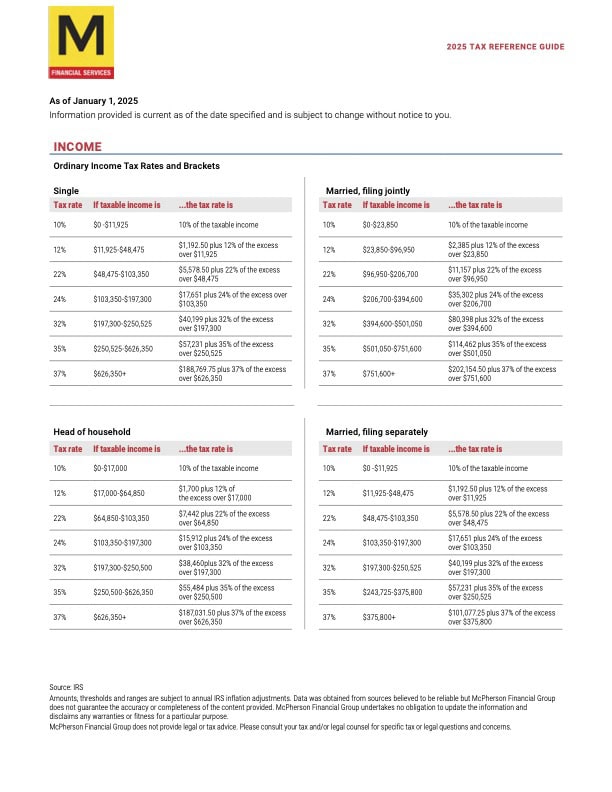

Download your 2025 Tax Guide by filling out the form below.

Answer a few short questions so we can route your request to the right department.