As you plan for the future, you might be asking yourself, “How can I minimize my tax burden in retirement?” or “What strategies can help me keep more of my hard-earned money?” Tax-related concerns can have a significant impact on your retirement plans, potentially limiting your financial freedom.

We focus on tax minimization planning and will help you find the best vehicle to help reduce your taxes and give you the best chance for tax-free income in retirement. We work with tax attorneys, estate planning attorneys, and CPAs to ensure the most accurate tax strategies can be implemented to take advantage of existing tax codes and regulations that change regularly.

On non-qualified accounts, we employ tax-saving strategies to reduce unnecessary taxable income to avoid jumping brackets due to capital gains and dividends. We have access to strategies where we can move between funds and fund families without creating capital gains or dividends. Normally, selling or moving from one family to another creates a taxable event and could cause tax related problems as a result. Tax-loss harvesting evaluates a portfolio’s total invested positions and sees if any short-term losses can be taken on an annual basis to limit tax exposure. We will coordinate with your current CPAs and attorneys to verify strategies that will work properly in your financial situation. If you do not have a CPA or an attorney, we will recommend one to you and connect you with them. Current tax returns show substantial tax risk due to capital gains and dividends if no losses are available to offset those gains.

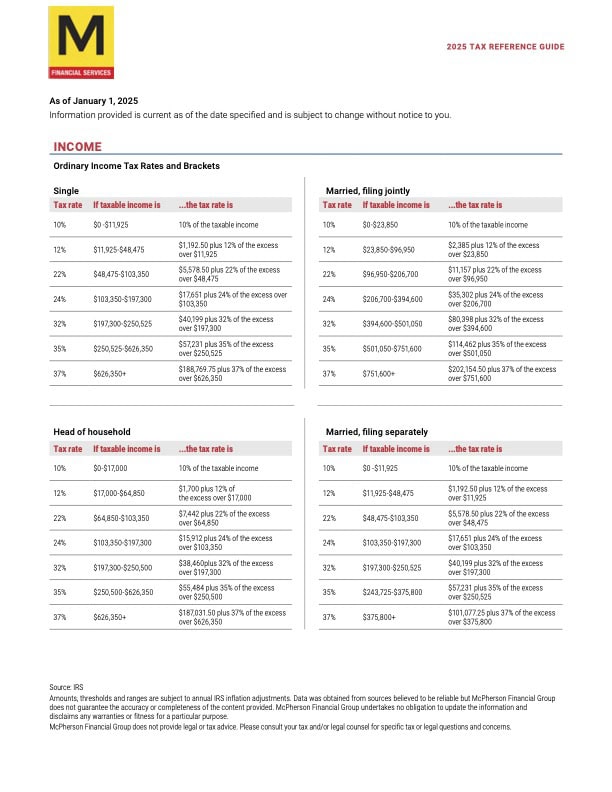

Download your 2025 Tax Guide by filling out the form below.

Securities offered through World Equity Group, Inc., member FINRA and SIPC, a Registered Investment Adviser

CRS for Prostatis Group LLC as the RIA

Investment advisory services offered through Prostatis Group, LLC. McPherson Financial Group, LLC and Prostatis Group, LLC are separate entities and are not owned or controlled by World Equity Group, Inc. Insurance services offered through McPherson Financial Group, LLC.

The access and use of any product, service or links on this website is subject to the terms of this disclaimer. McPherson Financial Group shall not be liable for any damages arising out of your reliance to any information provided here. The information and materials provided here, whether supplied by a third party websites, marketing materials, newsletters or any form of publication are provided for general information and circulation only. None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any product or financial instrument. It does not take into account of your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute investment advice, and does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular person.

Any expression of opinion is subject to change without notice and is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of the information provided.

Logos and trademarks used are the property of their respective owners and no endorsement by those owners of the producer is stated or implied.

Alternative investments have unique risks and are not suitable for all investors. Alternative investment products, including hedge funds, commodity hedged accounts and managed futures, involve a high degree of risk, often engage in leveraging and other speculative investment practices that may increase the risk of investment loss, can be highly illiquid, are not required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual funds, often charge high fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager.

Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop. There may be restrictions on transferring interests in any alternative investment. Alternative investment products can execute a substantial portion of their trades on non-U.S. exchanges. Investing in foreign markets may entail risks that differ from those associated with investments in U.S. markets.

1094294-0321

Answer a few short questions so we can route your request to the right department.